Foreign Direct Investment in Asia

Place: Asia • Dates: 2006-7 • Partner: ADB

Project Summary

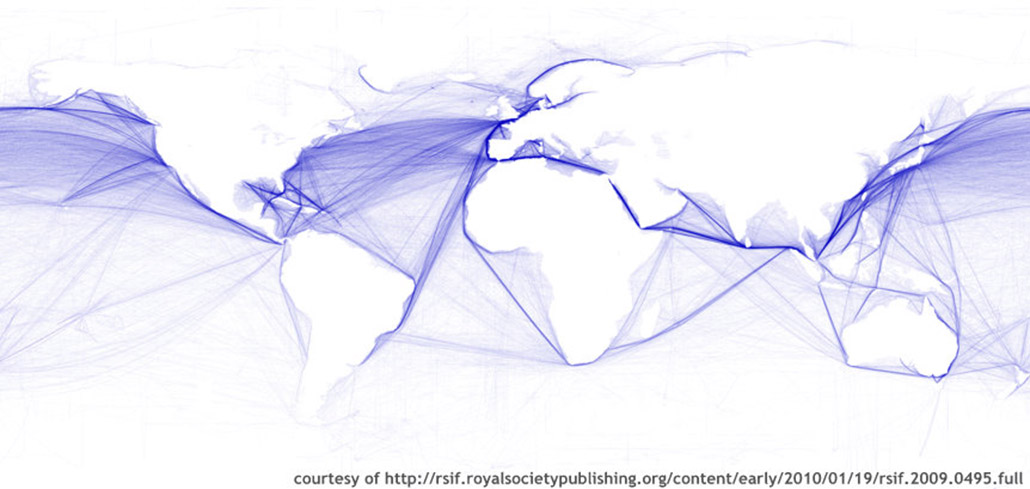

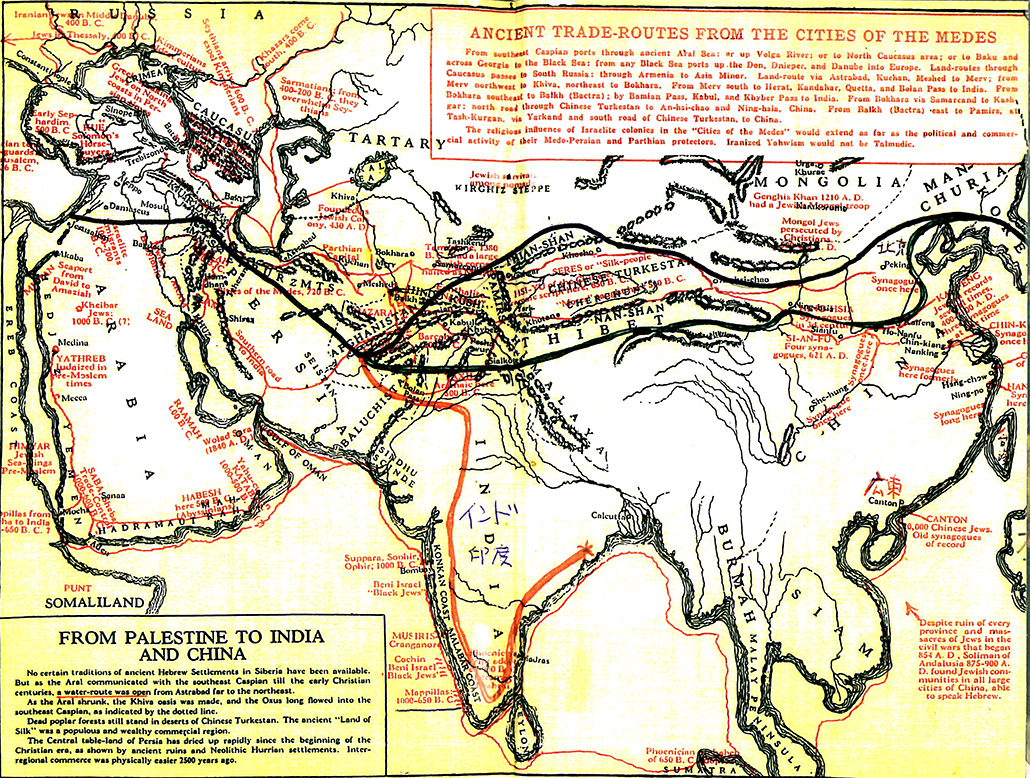

International capital mobility has been an essential component of modern globalization and a strong catalyst for growth in many emerging market economies. For Asia in particular, FDI has played a prominent role in the majority of dynamic and sustained success stories, supplementing domestic savings and transferring a variety of technical and market externalities to accelerate modernization and outward orientation. The development process across Asia is only partially complete, however, and the next phase of regional growth will need to propagate successful experiences across a more diverse set of initial conditions. To take full advantage of the transformative role that FDI can play in this process, a better understanding of the fundamentals of international capital allocation is essential.

This paper reviews the literature on FDI determinants from a regional perspective, followed by application of a variety of empirical approaches to elucidating these issues. Absence of definitive econometric results in this area lead us to apply a simulation framework to the same kind of specification in an effort to assess the potential significance of each of the three drivers. For plausible elasticity values (borrowed from the investment literature), we find again that real GDP is the primary determinant of regional capital allocation when FDI is endogenous. In the context of globalization scenarios for multilateral tariff reduction, this apparently induces transfers of growth impetus between economies, making former winners from globalization into losers. To the extent that accelerator effects may be amplified by FDI, it is essential to get better estimates of these effects.

Looking beyond the empirical evidence on macro drivers of FDI, we use our modelling framework to examine how FDI might be linked to trading efficiency and domestic productivity. Here we see that, for moderate levels of efficiency and productivity effects, growth dividends in the Asian region can be very substantial. In particular, our findings echo earlier work indicating that structural barriers to trade are now much more significant impediments to regional integration and expansion that nominal protection. We also find, to the extent that regional capital allocation follows principles of modern portfolio theory, capital-productivity linkages can accelerate growth dramatically. The analysis here thus shows that further research in several areas could be productive. In particular, incorporation of the portfolio model in CGE analysis could highlight direction and magnitude of capital allocations. While considerable work has already been done to identify the determinants of FDI flows, this portion of the feedback loop between growth and investment still lacks consensus. Better estimation of the accelerator effects of capital- productivity linkages on growth would also improve out understanding.

As Asian regional savings and investment flows rise to unprecedented levels, it becomes ever more important to improve our understanding of FDI-growth linkages. The results presented here offer guidance about new directions for more detailed research in this important policy area. If the forces at work are as momentous as some believe, then growth need not be a fixed-sum game and all could benefit from more efficient regional resource allocation. To ascertain the potential of such win-win scenarios, more experimental study of the FDI-growth nexus is needed.

Most Recent Entries

Low Carbon Biomass Conversion in the Sierra Nevada