Project Summary

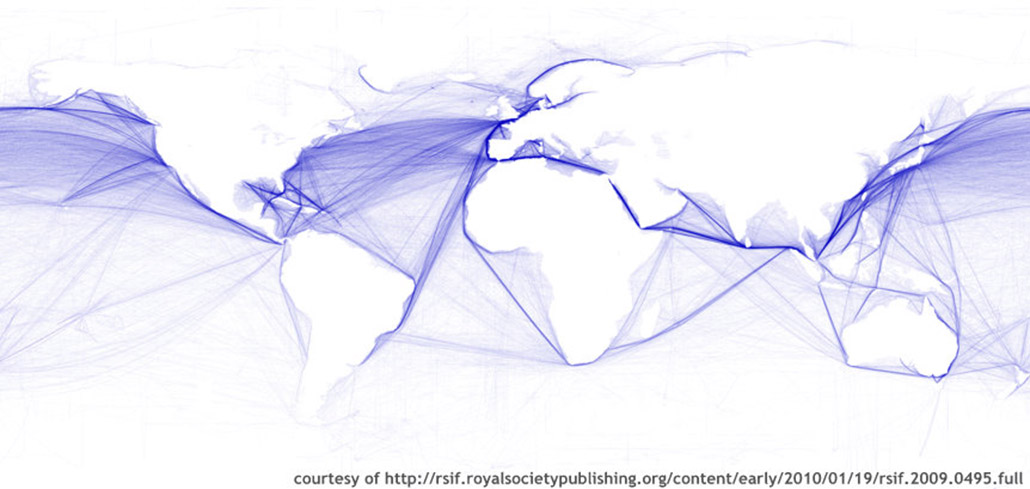

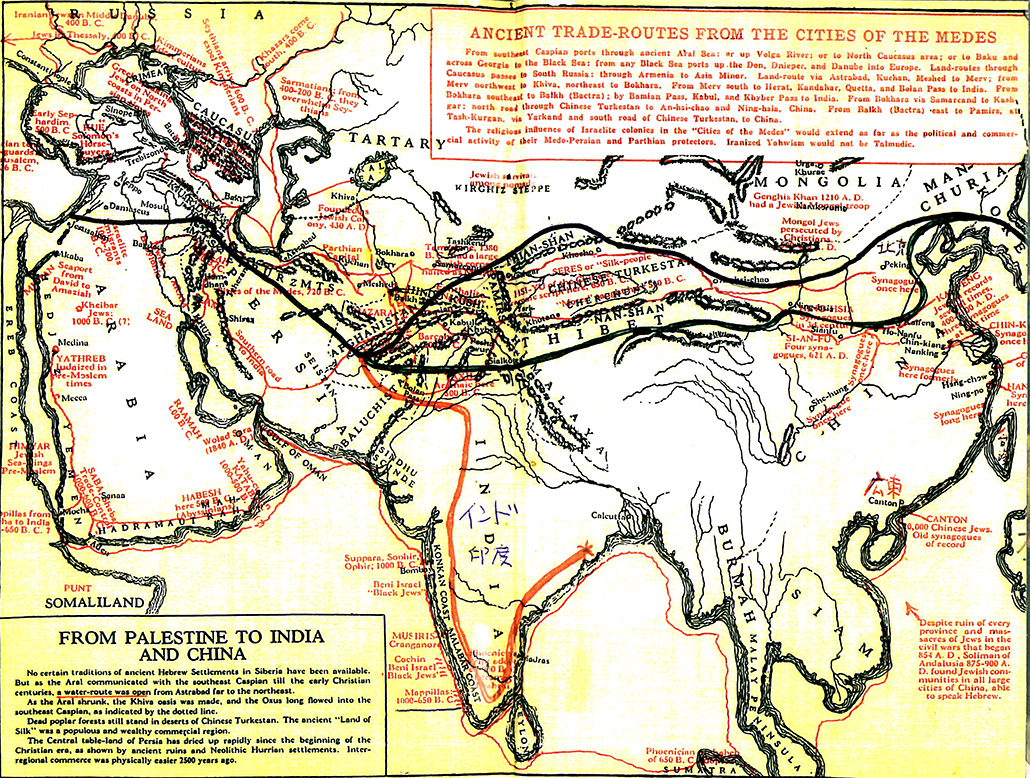

As the global economic regime shifted from post-colonial bilateralism to multilateralism, one of the most dramatic events has been the emergence of private agency. Beneath the official veneer of open multilateralism and WTO sponsored globalization, there is a remarkably diverse and dynamic mosaic of private commercial linkages that link the world’s economies. These linkages are generally incorporated in global networks or supply chains, where ten, hundreds, even thousands of intermediate product linkages are realized through bilateral deliveries within and across boundaries. The result is a remarkably diffuse mosaic of economic activity, coexisting with and often transcending official networks of bilateral and multilateral diplomacy and trade negotiation. As the system has grown in scope and complexity, well beyond the administrative capacity of individual enterprises and nation states, it relies for its existence on price mediated market interactions and a liberal trade an investment climate. With better understanding of this complex web of linkages, policy makers can see both the rewards of multilateralism and the importance of policies that facilitate it.

In this paper, we analyze these global supply networks, particularly in the context of East Asia and in recognition of the catalytic role played by international capital allocation or FDI. What we see in today’s global economy is a process of supply chain decomposition, where FDI is distributing production tasks across an international matrix of intermediate producers. Individual components of this production matrix are chosen for a variety of reasons, only one of which is the traditional Ricardian or Heckscher-Ohlin criteria of relative resource cost. At least as important for many firms is market access, domestically or in a neighboring country. Transport costs, infrastructure, network externalities, and administrative climate are also important. Finally, it makes sense for firms to diversify their supply chains simply as a hedging strategy, where the components of risk can be local, national, or global.

In East Asia, this process has advanced very rapidly and pervasively, facilitated by both western FDI and a regional cascade effect, where more advanced Asian economies re-allocate production to less advanced ones. In the process of distributing supply chains, foreign investors in the region create new nodes of production in different localities, and another indirect phenomenon emerges. Bamboo Capitalism describes a process where fully autonomous enterprises and markets sprout from these nodes in the “root system” of global intermediate supply. This process is long established in the Tiger economies and can be seen to emerge now in China (and across China) and other emerging Asian economies. The result is replication of industries and markets are an exponential rate.

To better understand the empirical significance of these phenomena, we present a novel approach to international multiplier analysis, based on a multi-country Social Accounting Matrix estimated from detailed data on domestic economic structure and international trade. This was used for multiplier decomposition analysis, and the results reported below support a general inference that multilateralism is a much more pervasive phenomenon than simple bilateral trade statistics would suggest. Indeed, we find that anywhere between 20 and 70 percent of total income realized in bilateral linkages arises from very long and complex multilateral chains of income-expenditure linkages. These network effects reach across geographic boundaries and sectors in ways that would be quite impossible for policy makers or trade negotiators to anticipate by intuition alones. Such “general equilibrium” trade linkages are apparently responsible for the majority of international value creation and trade. For this reason, the conventional view of gains from trade seriously understates the value of more a more liberal global trading environment.

Global supply networks have leveraged the world’s resource base and a more liberal trading environment to increase incomes in ways more pervasive than most of us can imagine, and broadening the basis for these activities can only amplify these benefits, distribute them ever more widely, and reduce the risks of economic concentration and instability.

Most Recent Entries

Low Carbon Biomass Conversion in the Sierra Nevada